Services. Amenities. Location. Floorplan. Availability of care. These are some of the community features that affect senior living cost. At myLifeSite, we’re often asked about comparing retirement communities and costs. Just last week, we received a question about whether a rental community is better than a community requiring an entry fee, sometimes referred to as a “buy-in.”

The challenge with questions like this is, like most things, it’s rarely black and white. No matter whether it’s an age 55+ independent living community, an active adult community, or a life plan community (aka “continuing care retirement community” or CCRC), there are two key concepts to keep in mind when financially comparing options, and each is connected to the other:

- There is a trade-off between cost and the community features mentioned above.

- Sometimes you pay more up front and sometimes you pay as you go, but the total senior living cost you will pay must come from someplace.

>> Related: Senior Living Community, Leaving an Inheritance: Is It an Either-Or?

Two real-world examples of senior living cost

Let’s look at an example. Suppose there are two new retirement communities that look somewhat similar on the outside. Each has a sprawling senior living campus with mostly apartments and maybe a few free-standing homes or townhomes. But one of the communities (Community A) provides a more limited offering of services and amenities and doesn’t maintain any separately licensed assisted living or nursing care residences on site. It does, however, contract with a home care agency when residents require care in their apartment or home.

The second one (Community B) has a much broader offering of services and amenities, even including things like an on-site spa and multiple dining venues. It also provides a full continuum of care services, which are available primarily to residents of the community. Of course, this doesn’t necessarily mean this option is better since everyone has different preferences and budgets.

Now, let’s go back to the two key concepts described above. In terms of the trade-off between cost and community features, the overall cost for Community B is clearly going to be higher since you are getting much more for your money. This is logical, but some prospective residents may focus more on cost without taking the time to fully understand the trade-offs between the options being considered.

Looking at it another way, would it be fair to say that Community B is more expensive than Community A? On the surface, yes. But that may not necessarily be the case when you take into consideration what you get for that price.

So, what about the second key concept: the payment structure? Community A is a rental-only community, much like you would pay to live in a typical apartment. In addition to covering the cost of services and amenities (either included or selected), the monthly rate also is based on the size of the unit/the floorplan and whether it is single or double occupancy. And if you should require a higher level of care than what can safely or practically be provided in your apartment, then you would likely need to move to a care facility.

Community B, on the other hand, is an entry fee community, falling under the category of a continuing care retirement community. And while you still pay a monthly service fee, in addition to the one-time entry fee, the monthly fee is less than it would be if there were no entry fee at all.

In other words, in terms of lifetime cost in Community B, you are effectively splitting it between paying some of the senior living cost upfront and some over time. And remember, the overall cost of Community B is typically going to be more than Community A because of all the additional amenities and services provided by Community B, including access to an on-site continuum of care.

But let’s suppose Community B switched to a rental-only model. The monthly rates would almost surely increase, probably significantly, unless services and amenities were reduced. In fact, this is evidenced by the increasing number of rental-only CCRCs that have a much higher monthly rate than comparable entry fee communities.

>> Related: Why Isn’t Senior Living Pricing Shown on More Communities’ Websites?

Even more retirement community cost factors to analyze

While doing your research on Community B, you also learn that it offers a substantial discount on the cost of care services that may be needed in the future. Given today’s exorbitant cost of long-term care, this can save you a lot of money down the road. You also learn that most of the entry fee for Community B may be refundable to your heirs or your estate, and possibly sooner if you decide to move out for any reason. (Be sure you understand the contract stipulations regarding CCRC entry fee refunds.)

Taking all of this into consideration, you can see why the two key concepts described above are so important to keep in mind and why doing the proper research is necessary to making an educated and empowered senior living decision.

Finally, remember that the two communities described above are only examples. Afterall, there are some 55+ rental communities similar to Community A but with higher-end services and amenities (and thus likely a higher cost), while there are CCRCs similar to Community B but with more modest offerings and possibly a lower cost. Senior living costs and options can vary drastically from one community to another.

>> Related: What Will My Long-Term Care Cost?

Financial confidence: A related factor in senior living cost analysis

When it comes to entry fee communities like Community B, there is another decision point for prospective residents to consider, which is the “financial viability” of the organization. You want to be sure the retirement community is in a financial position to uphold the contractual commitments it has made to residents in the long term. Learn more about how to evaluate a retirement community’s financial viability.

Since residents of entry fee retirement communities are making a larger financial commitment up front, and since they are planning to stay there for the long-term (as evidenced by lower resident turnover rates compared to non-entry fee communities), the financial strength of the organization is a particularly important factor in the decision-making process.

In addition to financial confidence in the organization, prospective residents of a retirement community also want financial confidence in their own ability to afford such a move and not worry about depleting their hard-earned savings.

Getting a full picture of senior living cost

Given all the nuances described in this post, it’s understandable why it is not always easy for a prospective retirement community resident to evaluate long-term financial affordability under various potential scenarios. It is wise to learn as much as you can about what you will get for your money under the terms of any retirement community contract, and then talk with your financial advisor about your ability to afford the senior living cost of your preferred community.

If you are a CCRC provider/operator, providing financial summary data and other information to help give prospective residents financial confidence in your organization is more important to your success than ever. Furthermore, providing online decision-support resources like our MoneyGauge lifetime affordability tool will help your prospective residents save time while evaluating affordability. Learn how tailored solutions from myLifeSite can benefit your retirement community prospects.

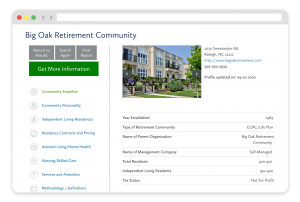

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities