During my financial planning days I regularly presented about senior living choices to groups of older adults at Duke University as part of the Osher Lifelong Learning Program. With approximately fourteen continuing care retirement communities (CCRCs or “Life Plan Communities”) within the immediate area I received lots of questions about these communities, which provide residents who are independent now with guaranteed or priority access to a continuum of care as their needs progress. Many of those I spoke with were comparing two or three different communities. The questions I received typically focused on types of contracts and payment plans, financial stability, non-profits versus for-profits, and, of course, affordability. It is this last one that I want to focus on in this post.

Statistics show that residents of CCRCs are, on average, more affluent than the general 65+ population. My experience in talking with prospective residents is that, from a financial perspective, the question is often not so much “can I afford a CCRC” as much as it is “to what extent can I afford it?” Many who are considering moving to a Continuing Care Retirement Community want a better understanding of what the financial impact to their estate could be based on a range of possible scenarios. For instance, “what if I live in the community for fifteen years or more and require several years of healthcare services.” Or, “Is it better to choose a lifecare contract or a fee-for-service contract?” They want to know how much will be left over for the kids in these scenarios after paying an entry fee, monthly fees, and the cost of care.

A Continuum of Care, but at What Cost?

For many who ask these questions it is hard to find answers. Some will try to “run the numbers” using an excel spreadsheet, but it is nearly impossible to account for all the moving parts, such as entry fees, refundable entry fees, fee adjustments that might take place within the community (which will vary depending on the type of resident contract and get even more complicated for couples), the impact of long term care insurance, inflation, growth on investments, etc.

The other option is to consult with a financial advisor, but in this case it is important to use an advisor that has an in-depth knowledge of CCRCs/life plan communities. Unfortunately, many financial planning software programs do not account from the nuances of CCRC pricing structures and how expenses may change based on the various stages of the continuum of care.

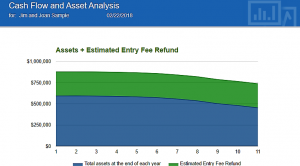

Fortunately there is another option to determine the potential long term affordability of moving to a CCRC. Created by myLifeSite, our CCRC financial tool will generate an easy-to-understand report revealing projected  savings and assets over lifetime, after accounting for the various inputs related to pricing, cost of care, type of contract, etc. The results are purely hypothetical (as is the case with any financial software that projects future results) but the nice thing is that you can quickly change inputs and then re-calculate to see a range of scenarios, thus providing a general sense of what might be expected.

savings and assets over lifetime, after accounting for the various inputs related to pricing, cost of care, type of contract, etc. The results are purely hypothetical (as is the case with any financial software that projects future results) but the nice thing is that you can quickly change inputs and then re-calculate to see a range of scenarios, thus providing a general sense of what might be expected.

This financial tool is currently made available to senior living admission teams who can use it to help prospective residents and their families gain a better understanding of the potential financial impact of this decision. The prospective resident may then share the report with their financial advisor if they wish. If you are evaluating a retirement community, particulary a CCRC, and would find this tool helpful be sure to ask if they have access to it.