By now, almost everyone is aware of the coronavirus disease 2019 (COVID-19) that is spreading around the globe. It’s impacting not only people’s health and travel plans but also the stock market. As a result, many of you have probably been contacted by your financial advisors, most likely encouraging you to stay calm in the midst of market uncertainty. But it can be scary when you see the Dow tumbling.

An independent view of the situation

Many of our readers are probably trying to figure out how best to financially navigate this time of uncertainty. After all, choosing a continuing care retirement community (CCRC, or life plan community) or other retirement community is a big financial decision, and the current market can cause apprehension.

I haven’t actively participated in the financial planning business for over eight years, but I do have expertise in the field, so I feel it may be appropriate to offer an independent view on the situation.

Of course, I am not qualified to speak to what could happen with the COVID-19 virus itself. I hope and pray that, as some have suggested, the number of cases will begin to subside as the warmer weather begins, but there are different views on whether that will occur.

If you remove China from the equation and account for the additional number of unreported cases, some suggest the death rate may be much lower than the approximately 2 percent that is frequently cited — maybe closer in line with what we see during a severe flu season.

>> Related: 4 Ways CCRCs Help Seniors Stay Healthy

COVID-19 creating uncertain times

But all of this points to the biggest concern as it relates to COVID-19’s impact on the stock market, which is uncertainty. I’ve seen a couple of articles in the media recently covering the length and severity of various recessions and stock market declines. But I don’t think we can apply this type of analysis to the current situation, because this time the dip isn’t being driven by a one-time event or general economic conditions.

To be sure, the world economy IS being impacted in a big way by COVID-19; it’s not just a normal economic cycle. Uncertainty is the enemy of the stock market.

In hindsight, we may find that the markets have overreacted over the past week or so. Maybe this pandemic becomes mostly contained over the next couple of months, and we see a bounce back from there. But if COVID-19 really takes hold in the U.S., then it’s almost certain that the market will see deeper declines.

Even before the threat of a pandemic, most economists were predicting a recession in the U.S. within the next year or two. A widespread outbreak of COVID-19 here in the states would likely shorten the timeline of this market scenario.

>> Related: CCRCs Keep Couples Close in Sickness and Health

But what should I do about my accounts?

Strictly from a stock market standpoint, I am not overly concerned about the steep declines we have faced over the past week or so. In fact, some would say this market was long overdue for a good correction.

I saw an interesting chart recently, which showed that the recent market decline has put the stock market more in line with the longer-term trend lines (measured using a rolling 100-day average). Prior to the dip last week, the market was well ahead of the trend line. In other words, a 10–20 percent decline puts the market back in line with where it probably should be anyway. I’ve personally had a really hard time justifying putting more money into this market over the past couple of years because it felt like it was the ultimate “buy high” situation.

>> Related: 3 Alternative Ways to Fund the Entry Fee at a CCRC

Proper investment allocation

The good news for retirees and older adults whose accounts are properly allocated (i.e., diversified, in accordance with your investment time horizon) is that you are probably at least 50 percent in cash, bonds, or a combination of the two.

Although it is the safest asset class, for some people, holding too much cash is tough to justify given the historically low interest rates we have today — rates which have helped to spur the stock market but are terrible for savers. Yet, unlike the Great Recession a decade ago, when virtually all asset classes declined, over the past couple of weeks, we have seen a more typical relationship between stocks and bonds. Stock values declined, and bond values increased.

Year-to-date, the S&P 500 Bond Index is up just over 3 percent versus the S&P 500 Stock Index, which is down almost 9 percent over the same time. If you owned a typical 60/40 retirement allocation of bonds to stocks, your total portfolio decline for the year would about 1.8 percent, compared to 9 percent for the stock market. (If you’re in your eighties or greater, you may be more like 80/20.)

The above is meant to be a simple example using only the S&P 500 stock and bond indexes. Other indexes and individual holdings would have different performance figures, especially if you have international exposure in your portfolio. But here’s the bigger point: In this sample scenario, over the past 12 months your total return would likely be closer to 10 percent, even including the declines of last week!

>> Related: 3 Reasons Seniors Delay a CCRC Move & Why They Should Reconsider

Keep steady during turbulent times

As with most things in life, perspective is important. I hope I’ve given you some information here that can help you stay a bit calm in the midst of the storm. Certainly, we need to watch the financial markets closely. And wash our hands often!

For those who choose to hedge a bit further and tilt their portfolios a little more conservatively — which means a shift from equities to bonds/cash — I personally don’t think it would be a “selling at the bottom” type of scenario, given what I just described above.

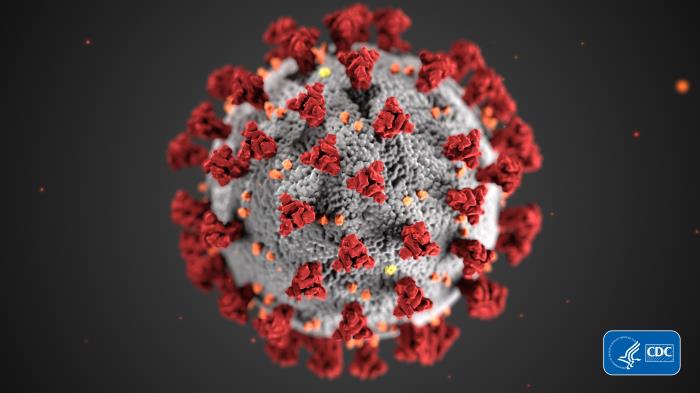

>> For more information on COVID-19, please visit the Centers for Disease Control website.

Please note: The above information should not be construed as investment or financial advice. Be sure to consider your own unique circumstances, and consult with your financial professional before making any decisions.

Photo credit: Alissa Eckert, MS and Dan Higgins, MAM, Centers for Disease Control & Prevention