The concept of senior living covers a wide spectrum of choices–typically including independent living communities and assisted living facilities, as well as continuing care retirement communities (CCRCs). Newly referred to as life plan communities, CCRCs often require an entry fee, and they provide services across the full senior living continuum, including independent living, assisted living, memory care, and nursing care. Many seniors, or perhaps adult children doing research on behalf of a parent, often wonder whether one of these senior living options is affordable. To help answer this question, it is important to be aware of the various options for paying for senior living.

Paying for Senior Living

Payment options for senior living fall into one of two categories: public support and private payment.

Public Financial Support for Paying for Senior Living

Government financial support for senior living is provided at both the federal and state level. This type of support mostly applies to assisted living and skilled nursing care, but does include some support for independent living.

- Housing and Urban Development (HUD): Affordable senior housing for older adults is available through HUD’s Section 202 Supportive Housing for the Elderly Program. HUD supported communities are designed to help low-income seniors live independently with supportive services such as meal-preparation, housekeeping, etc. Learn more about the HUD program.

- Medicare: If only assisted living is needed, Medicare will not cover the cost of these services. However, it will likely cover some skilled nursing care expenses, for a limited period of time, if those services are delivered by a Medicare-certified provider. Learn more about what Medicare covers.

- Medicaid: Medicaid is a government safety-net program. Unlike with Medicare, both assisted living services and skilled nursing care may be covered by Medicaid, if you qualify financially and if such services are delivered by a Medicaid-certified provider. Eligibility requirements vary by state, but generally speaking, your available assets and income sources must be at or below the federal poverty level. Learn more about what Medicaid covers.

- Veterans Administration: Veterans and surviving spouses of veterans may qualify for the Aid and Attendance Program, a valuable benefit available through the U.S. Department of Veteran Affairs. If you qualify, this program can help cover the cost of assisted living and skilled nursing care.

Private Pay Options for Senior Living

In situations where public financial support is not available or accepted by a senior living provider, the resident of a senior living community will be required to cover the cost by their own financial means.

Want to offer prospects a look at lifetime affordability in your community? Learn more about adding MoneyGauge to your CCRC website.

In addition to using income sources and/or savings to cover the cost, here are a couple of other options:

- Selling the home: Retirees who choose to move to an entry fee retirement community, such as a CCRC, often sell their primary home and use the proceeds of the sale to cover the entry fee. If no entry fee is required, then the equity could help cover the monthly fee for years to come.

- Long-term care insurance: This type of insurance is most appropriate for those whose assets are too high to qualify for Medicaid but who do not want to take on the risk of paying out-of-pocket for all of their future assisted living or nursing care needs.

- Reverse mortgage: More seniors are turning to a reverse mortgage as a way to help cover the cost of in-home care. A reverse mortgage allows you to convert part of the equity in your home into cash without having to sell your home. Of course, a reverse mortgage uses up the equity in your home, so your heirs will get less. If you consider a reverse mortgage, be sure to do your homework because they can be complicated and the fees can be high in some cases. Get more information by visiting the reverse mortgage section on the website of the Federal Trade Commission.

- Life Insurance: Many older adults have full-life insurance policies that have built up substantial cash value over the years. If the life insurance is no longer needed, then the cash value in the policy could be used to cover some of the cost for senior living. Before borrowing money from a policy or cashing out a policy altogether, make sure you are fully aware of any tax implications or other penalties. There are even some companies that will purchase a life insurance policy from you for an amount that is higher than the cash value in the policy, but the company essentially becomes the beneficiary of your policy at that point. In short, they make their money when you pass away, and not everyone is comfortable with that set up. If you do consider this type of arrangement, be sure you are fully aware of the details and fees associated with the transaction. And it is probably wise to have an attorney review the contract’s terms.

Understand your options

The costs associated with some senior living options can seem daunting, even overwhelming. But understanding the different types of facilities and the potential ways of paying for housing and care can help you make an informed choice that works best financially for you and your loved ones.

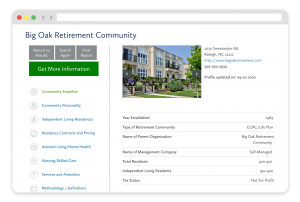

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities