According to data collected at myLifeSite, about three quarters of all continuing care retirement communities (CCRCs, or “life plan communities”) require an entry fee, and about 80 percent of these offer a refundable entry fee, with 50 percent and 90 percent refunds being the most popular. It isn’t uncommon for one community to offer a refundable entry fee contract in addition to a traditional, declining-balance entry fee contract.

What’s the best CCRC contract choice?

With so many CCRCs offering refundable entry fee contracts, a reasonable question often asked by consumers is whether it makes good financial sense to choose a refundable contract compared to a traditional contract. Before I offer my insights, it’s important to understand how refundable entry fees work compared to traditional contracts. The following is an abbreviated version of the explanation given in my book, “What’s the Deal with Retirement Communities?”.

Here is an example of how a traditional, declining-balance contract works:

The entry fee for a two-bedroom cottage at ABC Community is $260,000. Under the traditional contract, the community amortizes the entry fee over the first four years of occupancy. If the resident is living in the community after four years, there would be no remaining refund available from that point forward. However, within the first four years, some portion of the entry fee would be refundable in accordance with a declining balance schedule.

Here is an example of how a refundable entry fee contract works:

Suppose ABC Community also offers a 50 percent refund option. With this option, the resident will receive a minimum of at least 50 percent of the entry fee if they vacate the unit or upon death, and possibly more if either occurs within the first four years of occupancy.

Using the examples above, the question from the resident’s perspective is whether it is wise to pay an extra $100,000 (for a total entry fee of $360,000) in order to get $180,000 back later? Or is it better to pay only $260,000 (keeping the additional $100,000) and get nothing back later, except within the first four years.

Whether or not the refundable contract is a better deal depends on the time frame, as well as other factors and assumptions. There will be a break-even point at which it would be a better deal prior to that point and a worse deal after that point. But if we know where the break-even point is, then we can at least decide if we think the odds are in our favor or not.

Here is how you can find the true net cost of each option:

Traditional contract

The cost outlay of the traditional contract in today’s dollars is $260,000. However, in order to determine the true net cost of this option, we also need to offset the outlay by the amount of potential growth on $100,000 that the resident is keeping by choosing the traditional contract over the refundable contract.

As an example, let’s use a 10-year time frame and a hypothetical 4 percent average rate of return on the $100,000 that the resident invests. In this case, the resident would earn an additional $48,000 over ten years. But the present-day value of $48,000 received in 10 years is around $36,000*. So, the cost outlay of $260,000 today minus $36,000 results in a true net cost for the traditional contract of $224,000 over a 10-year time frame.

Refundable contract

The net cost of the refundable contract in today’s dollars is $360,000 minus the present value of the refundable portion of the entry fee. Using the same 10-year time frame, the present value of $180,000 received in 10 years is around $134,000. Therefore, the true net cost of the refundable contract over a 10-year time frame is $226,000 ($360,000 minus $134,000).

The bottom line on refundable entry fees

Since the difference between the above scenarios is only around $2,000, we know the breakeven in this example is around 10 years, after which the traditional contract would be a better deal. Yet, this does not mean that this will always be the case. If I change any of the assumptions, such as the inflation rate, time frame, rate of return on my invested money, or contract pricing, then the calculations will be different.

* Hypothetical inflation rate of 3 percent

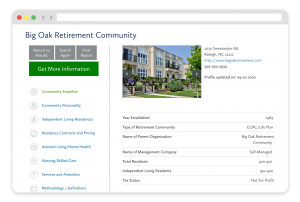

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities