Elder guardianship is a legal process that is used when a person is unable to make their own decisions or communicate their wishes about healthcare issues, finances, property, etc. Once elder guardianship is granted to another person or entity through the court system, your individual rights to manage your personal affairs, money, and/or property are removed.

Sound scary? It can be. Florida resident Willie Berchau was confined to a dementia unit for more than two years after a professional guardian sold his home and had him committed. In New York, Dino Palermo was sued for guardianship of his wife, Lillian, after questioning an increase in the monthly cost of her care at a nursing care facility.

>> Related: How Does Nursing Home Billing Work?

According to Lauren Watral, MSW, CMC, owner of Raleigh Geriatric Care Management, LLC, seniors can help avoid these types of scenarios through effective communication with their adult children. “It is most important to talk to your family about your end-of-life wishes, healthcare, and financial issues,” Watral advises.

By drawing up important documents—like power of attorney, healthcare power of attorney, and advance directives (i.e., living will, do not resuscitate order, etc.)—seniors and their families are better protected against situations that can lead to third parties obtaining elder guardianship. In addition, Watral notes if circumstances warrant that family members need to petition the court to obtain guardianship, the legal process can be a costly and time-consuming endeavor if these documents are not already in place.

>> Related: Power of Attorney Documents Can Alleviate Problems Later

Elder law attorneys and geriatric care managers are good resources for further information about elder guardianship. A comprehensive list of other organizations associated with elder guardianship is available at this link.

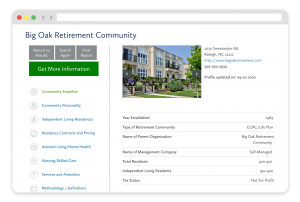

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities