Have you had “the talk” with your spouse? No, not THAT one! The one about where you want to retire! With work and raising children in the mix, it is not uncommon for couples to be so busy with the details of day-to-day living earlier in their lives that they never “get around” to having this important conversation.

But as retirement approaches, couples may find that they have very different visions for their “retirement dream home.” Maybe you are thinking a condo community on a golf course near the beach, and she is thinking a mountain lake house with land for solitude. That’s a pretty vast geographical and philosophical difference!

Here are a few points to think about when having “the talk” with your spouse or partner about your future retirement destination:

- Do your research: Just as you want to date a person before you marry them, you should do the same with a prospective retirement location. Be sure to do your due-diligence to ensure you truly LOVE the location you are considering before you buy. Consider a “trial run”–rent a place for six months to a year before you commit to purchasing real estate. Think you want to go the RV route? The same advice applies: rent one first!

- Think about the future: While it is impossible to foresee every possible scenario that could occur in your later years, it is crucial to think about whether your chosen retirement destination will be a home that is suitable for the long-term, even when you are much older. Take into consideration factors like your physical ability to maintain the home as you age, the number of stairs in the residence, etc.

- Determine the importance of friends and family: Many people underestimate how difficult it can be to leave behind a well-established network of friends when they retire to a new location. Also consider the importance you place on time with children and/or grandchildren when selecting a retirement spot.

- Look at financing options: Don’t make the mistake of putting down too much cash on your new home, leaving you “house rich and cash poor,” as they say. Once you reach the retirement stage of life and are living on a fixed income, having cash on hand can become more important than ever, especially if an illness occurs. Discuss your cash liquidity needs with a financial planner before you select a home financing option.

- Be conscious of current versus future income/expenses: Too often when buying retirement property, seniors get in over their heads financially because they are planning for the moment, not for the future. Think about the impact of inflation on your income versus housing expenses (maintenance, lawn care, heating/cooling costs, etc.). Also keep in mind the income and tax implications when one spouse dies.

- Consider transportation needs: Most people will not (or should not) be driving after a certain age. This is an important consideration when selecting a retirement spot. Will you be in walking distance to stores, places of worship, and restaurants? Factor in larger airports (if you want to travel during your golden years), numerous public transportation options, and the availability of excellent healthcare, and this could be the deciding reason to choose a more metropolitan area for your retirement dream home.

With careful planning and thoughtful discussion, you and your spouse should jointly determine your retirement living destination. Creating individual priority lists, as well as a joint pro/con list, can be helpful exercises for your conversation and to guide you toward a mutually-agreeable location to spend your golden years.

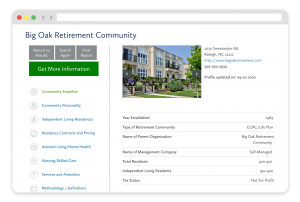

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities