Continuing care retirement communities(CCRCs)are a wonderful solution for many retirees who are independent today but seek the peace of mind of living in a community that can provide for future healthcare needs. When I speak to groups about these increasingly popular, but often complex, retirement living arrangements one of the questions I am most often asked is whether families should avoid for-profit (FP) retirement communities and seek only not-for-profit (NFP) communities. The question is almost always prompted by the idea that NFP communities “won’t kick you out” if you run out of money. This message tends to resonate among consumers for obvious reasons. Yet, it should not be taken as a blanket statement and it should not necessarily cause you to exclude all FP communities from your search.

While there are other aspects of the “NFP or FP” analysis, for the purposes of this post I want to focus specifically on the matter of resident financial assistance. The reality is that many CCRCs, both NFP and FP, seek to continue providing care for residents who are no longer financially able to do so but they also reserve the right to terminate the contract under certain circumstances.

The idea that NFP communities will not force a resident to leave if they run through their money is one that stems from the fact that NFP communities are generally more mission driven. A requirement for obtaining not-for-profit tax status is that the community maintains a charitable mission. Part of this mission is almost always to provide living accommodations and healthcare for residents whose finances may have been unexpectedly impacted in a negative way. Perhaps, for example, a resident experiences a longer than average stay in the healthcare facility, which depletes their assets. In effect, not-for-profit CCRCs have a responsibility as part of their tax-exempt status to provide such financial support. (It should be noted too that residents of NFP communities often appreciate the mission-driven culture of NFP communities for other reasons aside from just the financial assistance aspect.)

Yet, as with most things in life, this issue isn’t exactly black and white. Ultimately a retirement community has a responsibility to do what is in the best interest of the community as a whole. So, while the mission is to provide financial support in these instances, the retirement community always maintains the right to ultimately force termination for lack of payment.

For example, if you were to look at the specific contract language for a not-for-profit CCRC it would likely read similar to the following: “The community may offer financial assistance to a resident who has encountered financial difficulty provided the resident has managed his or her personal resources properly after taking occupancy… such assistance will be conditional on the community’s ability to provide funds while operating on a sound financial basis. The resident’s estate will be responsible to repay the deferred fees. The [Community] Charitable Fund was established to help provide charitable funds to residents in need.”

Clearly there is a bit of gray area here; financial support is rather conditional and is not by any means guaranteed. Who decides what “managed his or her personal resources properly” means? Furthermore, what if the CCRC is in poor financial condition? Surely that would impact the community’s ability to provide financial support without further impacting the community’s finances. Of course, sound financial practices, actuarial projections, and appropriately set entrance requirements are intended to minimize the likelihood of such a situation.

Also, many people do not realize that the resident’s estate will often be responsible to repay any financial assistance provided, as indicated in the language above. (I’m not suggesting that this is bad policy; just that people often do not realize this.)

It is not uncommon for not-for-profit CCRCs to maintain a benevolent fund or “financial assistance fund” to help support residents in financial need. But simply having such a fund does not guarantee assistance. The fund needs to be adequately “funded” on an ongoing basis. If a higher-than-expected number of residents require assistance then the fund could dwindle in size.

It is also important to recognize that some NFP retirement communities are actually owned by FP entities. (An analysis of such a business arrangement is worthwhile but beyond the scope of this article.)

Okay, now let’s talk about for-profit (FP) CCRCs. In contrast to NFP communities, for-profit CCRCs generally tend to be less mission driven and more profit driven, hence their “for-profit” tax status. But when I randomly pulled up several for-profit CCRCs in our LifeSite Logics database I found that in some cases that the contract language on this matter read quite similarly to that of the NFP communities.

The first one I pulled up read as follows: “The community may offer financial assistance to a resident who has encountered financial difficulty provided the resident has managed his or her personal resources properly after taking occupancy…such assistance will be conditional on the community’s ability to provide funds while operating on a sound financial basis. The resident may be required to move to smaller unit. [Community] Foundation may provide financial aid to residents. The resident or resident’s estate will be responsible for repaying deferred funds, if possible.”

The language is almost identical to that provided by the NFP community referenced above. Notice that even though this is a FP retirement community they still maintain a charitable fund to provide financial aid for residents. As with the NFP communities the fund needs to be properly funded in order to be effective.

I did, however, find several FP communities that were significantly less generous and stated quite clearly that they would terminate a resident’s contract after a number of days if payment was not received. Here is how one read: “Nonpayment of fees is considered grounds for termination of the contract.” Ouch. Not quite as inviting! Clearly, CCRCs following such protocol will indeed “kick you out” if you cannot pay.

In summary, while it is true that not-for-profit CCRCs generally try to provide financial assistance for residents who have experienced financial difficulty it should not necessarily be assumed that every NFP will always be in position to do so. Plus, the extent to which a community chooses to be “charitable” could vary from one NFP community to another.

On the other side, it also should not be assumed that all FP communities will immediately terminate a resident’s contracts if the resident is not able to pay. Even though a for-profit CCRC may not be as mission driven as some NFP communities they may simply feel that providing assistance for residents who have experienced financial difficulty is good business policy. Or perhaps they hope it will help them maintain a strong public image. But to be sure, some FP communities are not as generous- as you saw from the last example above.

As with any other aspect of the CCRC decision process, the issue discussed in this post is one that that should be addressed specifically with retirement community(s) that you are considering- whether NFP or FP. You should seek learn about the community’s view on this matter, their specific policy and history of providing such assistance, overall financial condition, as well as the status and maintenance of any charitable or financial assistance funds.

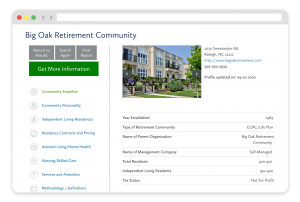

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities