Vacation season is upon us with many people chomping at the bit for a change of scenery after a year in lockdown. If you are approaching retirement age, vacation season might also be a time when you consider if it would be desirable to purchase a second home — either to split your time or live in full-time once you retire.

Considerations for a second home in retirement

For people who have successfully paid off their primary residence, fully funded their retirement account and rainy-day savings, and planned for any college tuition costs, a vacation home may be well within your reach financially. But as with most things, there are potential pros and cons to second homeownership.

Here are a few important considerations to take into account before you buy that vacation home with a plan to eventually retire there.

>> Related: The Value of a Solid Support System During Retirement

Location

You know the cliché about the three most important factors of real estate: location, location, and location. But this may be even more true if you are a senior pondering a second home purchase. You will want to factor in the desirability of the location to you personally. For example, if you’re a “beach person,” maybe a mountain home, while nice, isn’t the best option. You likely will want to think about proximity to family as well.

But another key consideration that increases in importance as you age is proximity to care — preventive healthcare, emergency services, and potentially long-term care services. A remote homestead in Wyoming may be quiet and picturesque, but it could be an hour-plus drive to the nearest hospital.

Cost

The cost of a second home is likely second in importance only to location. And cost considerations extend beyond the selling price. You’ll need to factor in expenses like property taxes, any homeowners’ association fees, homeowners’ insurance, and utilities. Additionally, you should budget in upkeep costs like lawn care, snow removal, and general maintenance.

Accessibility

When browsing real estate listings, you will want to take into account the layout of a second home. For instance, as you age, it may be increasingly desirable to have a first-floor master with an accessible bathroom (e.g., a walk-in shower). You also may want to consider the number of stairs to be navigated to get into the home and to the master bedroom and bath.

Things like adequate lighting, non-slip floor surfaces, and wide hallways and doorways are examples of other features to look for. If there is a chance you may live in this home full-time in the future, such accessibility features could be increasingly important to ensure your comfort and safety.

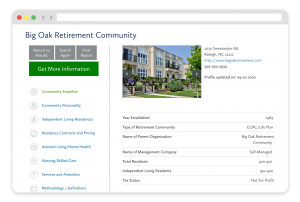

For this reason, it may be worth taking a look at an active adult living or independent living 55+ community for your second home. Properties in these communities will typically include accessible floorplans and other safety features.

>> Related: The Pros & Cons of 55+ Active Adult Communities

Other important financial factors

How will you’ll pay for it?

If you own your primary residence outright, second-home ownership may be attainable for you. After all, many people who purchase a vacation home use the equity in their primary residence to pay for all or a portion of the second home.

But you may want to proceed with some caution before spending your home equity. For example, if you are considering an eventual move to a life plan community with an entry fee, bear in mind that most people pay that entry fee with the profits of selling their home. Other people who plan to remain in their existing home as they age may need that home’s equity to pay for any in-home long-term care services.

Do you hope to earn rental income?

If you plan to split your time between a vacation home and another residence, you may be able to fetch some rental income from one or both homes. But it is wise not to bank on rental income in order to make a property affordable to you. The rental market can be seasonal and quite fickle depending on your location as well as economic factors that are out of your control. You should ensure renting is permitted for any given property, as well.

It also can be quite time-consuming and expensive to manage your rental property, especially from afar. Rental management companies can simplify this task, but they can be pricey. Typically, such firms take a percentage of your rental income — often in the range of 20 to 35 percent, but sometimes as much as 50 percent of the rental rate.

What are the tax and estate implications?

For tax purposes, you will need to decide which home you will claim as your primary residence. If the homes are in difference states, this can have a huge impact on your tax bill. It would be wise to consult with a seasoned tax professional to learn about tax implications before you decide to buy that second property.

In addition, you will need to amend your will to factor in the vacation home. How will that purchase effect your estate, the estate taxes your heirs might owe, and your executor’s task list? You should seek advice from an experienced estate attorney to get a better understanding of these potential ramifications.

>> Related: You May Be Able to Deduct Some CCRC Costs from Your Taxes

Easing into retirement with a second home

If you have planned and saved adequately for retirement, a second home can be an enjoyable purchase for you and your loved ones. A second home also can serve as a means of easing the transition into retirement and, eventually, a senior living community.

Initially, some seniors will opt to split their time between the second home and their primary residence before moving to the vacation home full-time. This approach allows you to eventually relocate to your desired retirement location while also easing the emotional strain that often accompanies selling a beloved long-time home.

Such a strategy also can aid the downsizing/decluttering process in a gradual manner. This too can set the stage to later transition into a life plan community where a continuum of care services are available to residents, if needed.

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities