What if you could live in a retirement community that offered services, amenities, and an atmosphere that rivals the world’s top hotels? This type of luxury senior living is exactly what some high-income older adults are looking for.

There is rightly a lot of focus on increasing the affordability of senior living — now and in the future — particularly for the average, middle-income retiree. However, research reveals that the market potential for higher-end, luxury senior living will also continue to grow as an increasing share of retirees fall into the high-income bracket. The industry is responding accordingly with the development of a growing number and variety of communities geared toward high-income prospective residents.

More retirees, more prospects for retirement communities

Over the past several decades, the market for senior living communities (particularly assisted living and independent living communities) has grown and evolved quite substantially, due in large part to the Baby Boomers. According to U.S. Census data, approximately 10,000 Baby Boomers reach retirement age each day. By 2030, all of the Baby Boomers will be at least age 65, and many of them are opting to move to 55 plus communities.

As with any business, supply and demand is an important factor within the senior living industry. Investors and managers of retirement communities must look at the market landscape and make strategic business decisions accordingly.

Thanks to an eye-opening long-term study sponsored by the National Institute on Aging, we are able to get a deeper understanding of the retirees of today and the future — including their potential senior living budgets.

>> Related: Are Today’s Seniors “Younger” Than Previous Generations?

A growing number of wealthy retirees

The Health and Retirement Study (HRS) is a longitudinal study that regularly surveys a representative sample of approximately 20,000 Americans who are age 50 and older. Conducted by researchers at the University of Michigan since 1994, the HRS includes information on economic, health, marital, and family status characteristics, as well as support systems for cohorts ranging from those born before 1923 all the way to early Gen Xers, who now are beginning to reach age 50.

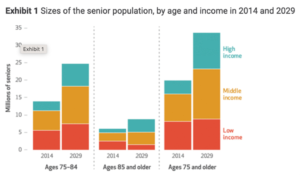

Among the HRS’s findings, as the Baby Boomers retire, the percentage of older people who fall into a high-income bracket is steadily growing. In fact, analysis of the HRS data (see Exhibit 1) shows that from 2014 to 2029, the number of retirees ages 75 and older who fall into a high-income bracket is expected to increase approximately threefold.

Image source: “The Forgotten Middle: Many Middle-Income Seniors Will Have Insufficient Resources For Housing And Health Care”; based on the study authors’ analysis of data from the Health and Retirement Study

This prosperity is attributable to a number of factors including savvy 401(k) investing, pensions, and an increasing number of retirees who are college-educated and thus garnering higher wages during their earning years.

This upward financial shift for retirees is a key driver in the growing demand for luxury senior living. From white-glove concierge services to lavish grounds — indulgent spas to five-star dining, some luxury retirement communities can put the finest resorts to shame. And accordingly, the price tag for residents’ monthly fees at these high-end communities can easily reach $10,000 or more.

>> Related: The Cost of a CCRC vs. the Value to Residents

Redefining the luxury senior living “vibe”

Interestingly, the luxury senior living market has recognized a shift in what today’s affluent retiree is looking for in a retirement community, however. A 2023 article in Senior Housing News underscores this evolving trend and draws an important distinction between “excellence” and “luxury.”

“Luxury is a feeling,” explained Lisa Swafford, vice president of strategy and business development at Galerie Living, a luxury life plan community provider based in Atlanta. “It’s how you’re treated; it’s how people are interacting with you.”

True luxury is about offering personalization, making residents truly feel special — what the article refers to as “a vibe.” And to achieve this “vibe,” some luxury senior living operators are drawing on the wisdom of renowned organizations like Ritz-Carlton, the Culinary Institute of America, and Forbes Travel Guide to train their staff.

The article highlights an anecdote used during the Forbes training. In the first example, a plate of fruit was colorful and looked tasty, but it was simply placed on the plate — an example of excellence. In a second example, the same fruit was arranged to look like a handcrafted flower — a presentation that exemplified luxury.

>> Related: Senior Living Communities Keep Upping Their Food and Dining Game

Luxury senior living communities offer a distinctive lifestyle

A sense of indulgence must extend beyond the dining room, however. Residents of luxury senior living communities want to feel special and pampered throughout their experiences within the community. That’s why some senior living operators catering to affluent retirees also train their entire staff — from housekeepers to caregivers to event planners — on ways to go beyond excellence to achieve true luxury.

For example, some luxury retirement communities offer resident-tailored classes on things like beekeeping and beer-making, or custom gourmet wine dinners — collaborations between renowned chefs and expert sommeliers. Others feature in-house art galleries or other highly curated on-site cultural opportunities.

Such luxury communities are designed to meet the aesthetic expectations of high-income retirees, as well. After all, many of their residents are moving from lavish homes and have traveled the world, experiencing the finer things life has to offer. These senior living communities thus are elegantly appointed and use high-end building materials to construct communities that might emulate the streets of Paris or mirror the finest Manhattan high-rise.

>> Related: CCRC Services and Amenities Include Many Attractive Perks

Senior living options needed for the less affluent

Many people are talking about what the future of senior living will look like, including the demand for luxury retirement communities. However, there are two important points that we’d be remiss not to mention.

First, it is vital to note that there cannot be a singular vision for the senior living industry’s future. Every older adult’s circumstances, needs, finances, and preferences are different. Therefore, there must be versatile options to meet everyone’s taste and price range. And innovation must continue around finding new and flexible ways to allow people to remain in their current home, if desired.

Second, the industry must not lose sight of the fact that only one-third of those ages 75 and older are high-income. Most are middle-income — with a growing number falling in this group — and roughly a quarter are low-income. A 2019 study called “The Forgotten Middle: Many Middle-Income Seniors Will Have Insufficient Resources For Housing And Health Care” highlighted this important point:

“Seniors housing operators and investors have largely focused on the upper end of the income distribution. For lower-income people, state and local programs provide housing and care services via means-tested programs such as Medicaid. For higher-income people, a large private-pay assisted or independent living sector has emerged to meet the demand for housing and care services.

Although some middle-income people are living in seniors housing, the industry has not primarily focused on this cohort. This income group is generally too wealthy to qualify for public means-tested programs, yet not wealthy enough to pay the costs at many seniors housing communities for a sustained period of time. Medicare does not cover seniors housing or long-term care services.”

It is thus essential that the industry’s growing focus on luxury senior living communities not occur at the expense of the large number of middle- and low-income retirees.

>> Related: Senior Living and Care Industry Must Create Solutions for Middle-Income Seniors

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities