Surveys show that one of the top reasons older adults delay or avoid a move to a senior living community, such as a continuing care retirement community (CCRC/”life plan community”) or other independent living community, is the concern over price and affordability. It’s understandable. Moving to a retirement community is a big enough decision on its own, not including the additional question of whether it will be financially feasible over the long term.

For many people, trying to assess the financial feasibility of senior living options can be challenging. There are so many moving parts or hypothetical possibilities, especially in the case of a couple. It’s even more difficult when evaluating a CCRC because different providers offer different types of financial contract models, and sometimes even hybrids of those models!

Here’s a summary of the different options available for assessing the long-term affordability of senior living, including senior living cost calculators.

Senior living cost calculators, projection tools & more

Using a financial advisor: Some financial advisors (FAs) are better equipped than others to generate accurate and reliable financial projections related to a senior living move. Again, this is particularly true when it comes to the complexities of a CCRC/life plan community. Even if the advisor is well-versed in the many nuances of CCRCs, the financial planning software they use may not be designed for this type of analysis. Learn more about what financial advisors may be overlooking when calculating CCRC costs.

Senior living budget comparison tools and worksheets: Many senior housing communities will offer a budget comparison tool, either on their website or in hard copy form, or both. These worksheets help compare your monthly expenses today with the projected monthly expenses at the retirement community. The results may reveal that the additional cost of moving to the retirement community is less than what you think because many of the things you are paying for at home today will be included in your monthly service fee at the retirement community, such as home maintenance, lawn care, property taxes, fitness classes and memberships, alarm systems, etc. In some cases, monthly expenses may actually go down after you move to the retirement community.

While these senior living budget comparison tools are helpful for comparing expenses today, they are not as useful in projecting long-term affordability, particularly when factoring in the cost of potential care needs, inflationary adjustments, long-term care insurance (if applicable), and more.

Floor plan affordability tools: Recognizing that many prospective residents of retirement communities want to know which types of floor plans are a good financial match for them — often before they are ready to take the step of coming in for a meeting or tour — some senior living communities offer floor plan affordability calculators. These senior living affordability calculators typically provide a broad estimate of the specific floor plans within the community that may be a good fit, after gathering basic information about income and assets. However, the results are typically not based on actual long-term financial projections, but instead on a rule of thumb. For instance, a floor plan calculator may be set up so that if your assets and income meet a certain multiple compared to the entry fee (if applicable) and monthly fee of a floorplan — let’s say one and a half or two times — then it will show any floor plans that fall within that price range.

While this tool is a helpful first step, the lack of a life expectancy-based calculation means that regardless of a person’s age, the results will be the same, all other things being equal. For example, two people with a 10-year age difference could enter the same information into the calculator and get the same results. In reality, however, those additional 10 years could make a big difference in affordability over their lifetime.

Affordability estimators: Not all financial affordability tools use calculations to generate results. Instead, some senior living affordability tools are more qualitative; asking the prospective resident a series of questions that when analyzed together help indicate whether a person may be able to afford the retirement community. The benefit of these tools is that the prospective resident doesn’t need to enter any specific financial information, yet the trade-off is that without this information it may be difficult to accurately assess long-term affordability, particularly as it relates to life plan communities that often have more stringent financial qualification requirements.

Financial pre-qualifiers: Developed by a CFP® professional and CPA here at myLifeSite, MoneyGauge is a financial pre-qualification tool used by retirement communities to help prospective residents independently assess their financial eligibility. There are several key differences between MoneyGauge and the previously described tools:

- MoneyGauge uses a financial algorithm to generate highly individualized calculations, taking into account life expectancy, income, assets, pricing, the future cost of potential care needs, growth rates, long-term care insurance, and more.

- Rather than showing floorplans, MoneyGauge uses “gauges” with different colors to visually represent potential affordability, based on average or starting prices for different categories of floor plans.

- Senior living communities using MoneyGauge can customize calculation settings and hypothetical assumptions to align with their internal preferences and financial qualification process (if applicable). Learn more about financial qualifications below.

After a prospect receives their MoneyGauge report, it is helpful to review the results with a representative of the community who can help analyze the results and offer more specific details about floor plans that are a good fit.

>> Learn more about myLifeSite’s financial tools and other resources.

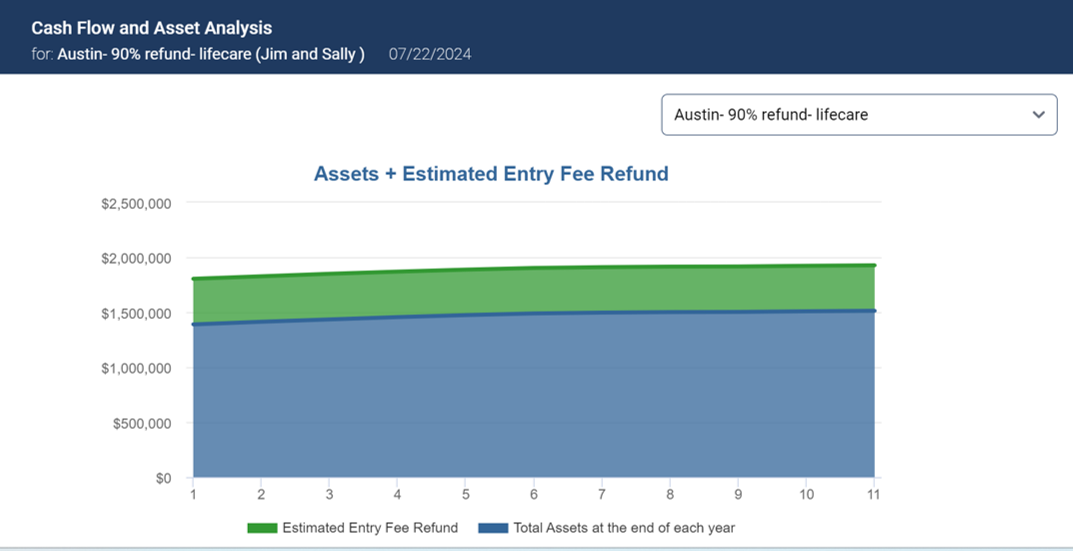

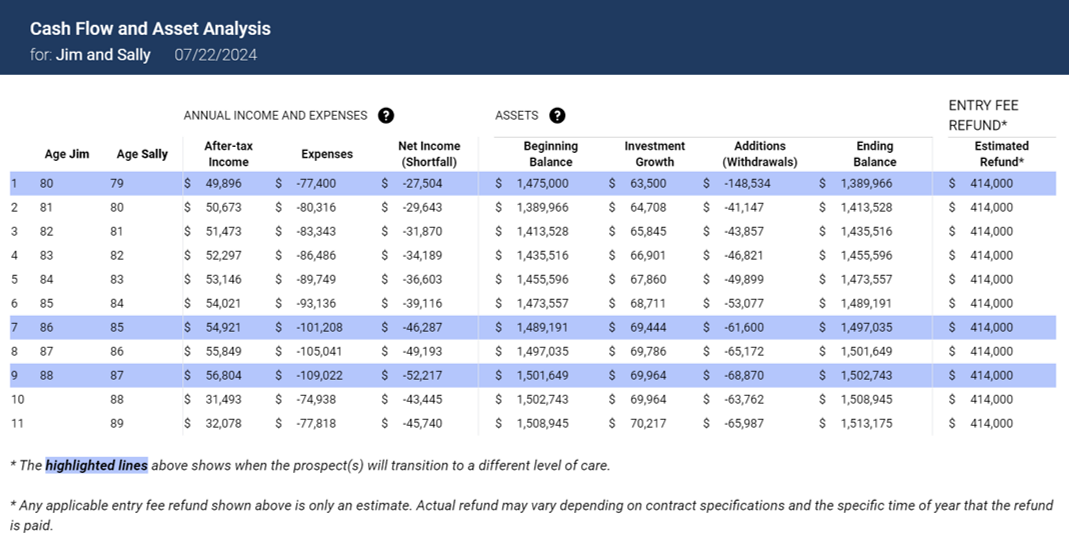

Financial projections and scenario comparisons: Sometimes it’s not just a matter of whether a person can afford the retirement community, but rather the extent to which they can afford it; i.e. how much money may be left over at the end. Similar to the types of projections a person might receive from a financial advisor, but with a focus on the many nuances of CCRCs and other senior housing options, myLifeSite also makes available a more advanced version of MoneyGauge, which is used one-on-one with prospective residents.

This financial projection tool is used by representatives at retirement communities, as well as some financial planners and senior living advisors, to prepare “what-if”- type scenarios and comparisons for clients. For those who are interested in a CCRC community but want to better understand the financial outlook, this tool provides colorful graphs, year-by-year reports, and comparisons of virtually any type of scenario they want to see. Any of the inputs can easily be changed, and within seconds, it will regenerate the results.

Actuarial-based calculators: Specifically regarding CCRCs/life plan communities, many such retirement communities provide either: 1) financial support for residents who exhaust their assets (due to no fault of their own), 2) a discounted rate for future care, and/or 3) entry fee refunds. It’s for these reasons and others that astute financial management of the organization requires leadership to quantify such future obligations — typically using thorough actuarial analysis — and ensure that future income and reserves are projected to match these obligations.

Along with this, it’s important that CCRCs do not expose the organization — and ultimately the residents — to undue financial risk by accepting new residents whose finances may not be adequate to support them through life expectancy at the community.

It is for this reason many CCRCs and life plan communities use an internal (back-office) financial qualification tool provided by an actuarial firm that helps assess the probability of a resident exhausting their assets before life expectancy, and thus the probability that the CCRC would be further increasing its future obligations beyond what is acceptable. The results of these assessments may or may not be shared with prospective residents.

Image credit: Pexels, Karolina Grabowska

Post updated: 7/22/2024

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities