Home. Just the word conjures feelings of comfort and emotional connection.

Most retirees prefer to live in their home for as long as possible. The idea of “aging in place” and staying in your home can be symbolic of maintaining your independence. However, to paraphrase John Lennon, “life happens,” so it is wise to have a back-up plan.

By planning ahead, you can consider how you will manage remaining in your home, as well as other living options, if an unforeseen change in circumstances or significant health event occurs. Proactive decisions now will help you avoid undue stress and urgency later.

Here are some things to think about:

- At some point, will you need to modify your home to accommodate changes in your mobility?

- Who will maintain your home—inside and outside—if and when you are no longer able?

- How will you stay socially active and avoid loneliness, which can have adverse health effects?

- Should you install a medical and emergency alert system? Which one?

- Who will tend to your day-to-day needs if you are no longer able care for yourself? Do you have family nearby who would be willing and able to help out, or will you hire someone to care for you?

- If you plan to rely on a family caregiver have you considered the potential emotional, physical, and financial impact your care could have on them?

- If you plan to hire in-home care, who will manage that process and schedule your care?

- Who will oversee your hired caregivers to help make sure you are receiving quality care and prevent abusive situations or negligence?

- If the time comes when you can no longer receive the level of care you need at home, where will you go to receive such care? Who will help coordinate that process for you?

By answering these questions now—with your loved ones—you can create the framework for a contingency plan, just in case.

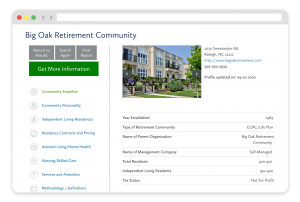

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities