The term “retirement planning” is frequently used in the financial industry and in the media. But what does it really mean? For some retirement planning includes strategies for saving and investing to prepare for a future retirement. For others it may focus more on various methods for tax efficiency and generating income during the retirement years. Of course, to others it may have less to do about money and more about the psychology of transitioning into retirement. Clearly, “retirement planning” is a broad topic.

I would like to encourage you to think about retirement planning from one other perspective. It’s no secret that people are living longer today than before. A seventy-year old in the U.S. today can expect to live another seventeen more years on average, with many living well into their nineties and beyond. With increasing life expectancy comes a greater need for a proactive approach to planning for the later phases of retirement. Yet, this is an area of planning that is often neglected by financial advisors and the general public alike. After all, long-term care insurance, which is owned by only a small fraction of retirees, is only part of a plan. It is not, in and of itself, a complete plan.

As a society we are still quite reactive in our approach to addressing the lifestyle and healthcare needs that we may face in our later years. We often wait until a significant health event occurs before we begin “figuring it all out” and, almost always, this responsibility then falls on the adult children or other family members who may not have the resources, flexibility in schedule, or emotional capacity to take on such a task.

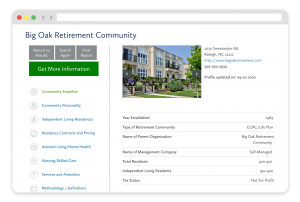

At myLifeSite we are passionate about seeing our society become better-educated on the various retirement living and long-term care alternatives, and having the necessary discussions with family members and valued advisors about what you might want for your future. We encourage a proactive approach by planning ahead- to the extent possible- for the later phases of retirement. You can begin by taking time to learn the differences between aging at home versus moving to a continuing care retirement community (CCRC) or some other type of retirement living choice. For more information be sure to take a look around the other pages on our website listed above.

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities