At LifeSite Logics we are passionate about seeing families, and their valued advisors, plan proactively for healthcare and long-term care expenses that may be encountered over the course retirement- particularly in the later phases of retirement. A recent study points to at least one key reason why more people don’t take a proactive approach to planning for such expenses.

Last year (2012) Fidelity Investments released their latest study on healthcare costs in retirement, which found that a 65 year-old couple retiring in 2012 is estimated to need $240,000 on average to cover medical expenses throughout retirement. And here’s the kicker….this figure doesn’t even include the cost of over-the-counter drugs, dental care, or long-term care! (According to the “2012 MetLife Market Survey of Nursing Home, Assited Living, Adult Day Services, and Home Care Costs” the national average monthly base rate in an assisted living community was $3,550 in 2012, or $42,600 per year).

The Urban Institute and the Employee Benefit Research Institute (EBRI) produced a similar study revealing that the median forecast costs of out-of-pocket healthcare spending by a woman retiring in 2020 at age 65 was $156,000 and for a man $109,000. (See December 2010 EBRI Issue Brief at https://www.EBRI.org) This study also doesn’t include the cost of long-term care, which could increase these figures dramatically.

The new study by a team of researchers at UCLA and Harvard University points to the gap between such forecasts and the consumer’s understanding of the issue. The study surveyed over 1,000 American between the ages of 40 and 80 and compared the results to EBRI data. Women surveyed guessed they would spend a median of only $30,000 and men thought they would spend a median of $60,000. These survey reponses represent underestimates of 80% and 45% respecitvely by women and men regarding the potential cost of healthcare in retirement. Of course, these figures point to the median cost but the actual cost for any person could vary drastically from the median, which makes it more challenging to plan.

Naturally, if the general public doesn’t grasp the magnitude of the potential healthcare costs they may face then there will not be a sense of urgency to plan for such costs. Financial advisors, long-term care insurance advisors, senior care advisors, estate planning attorney’s and other professionals in the business of serving as a trusted advisor are in postition to have a hugely positive impact on families by helping illustrate and plan for the realities of potential healthcare and long-term care expenses in retirement.

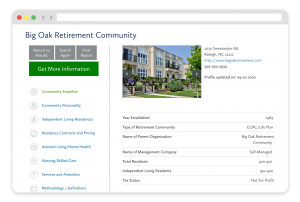

FREE Detailed Profile Reports on CCRCs/Life Plan Communities

Search Communities